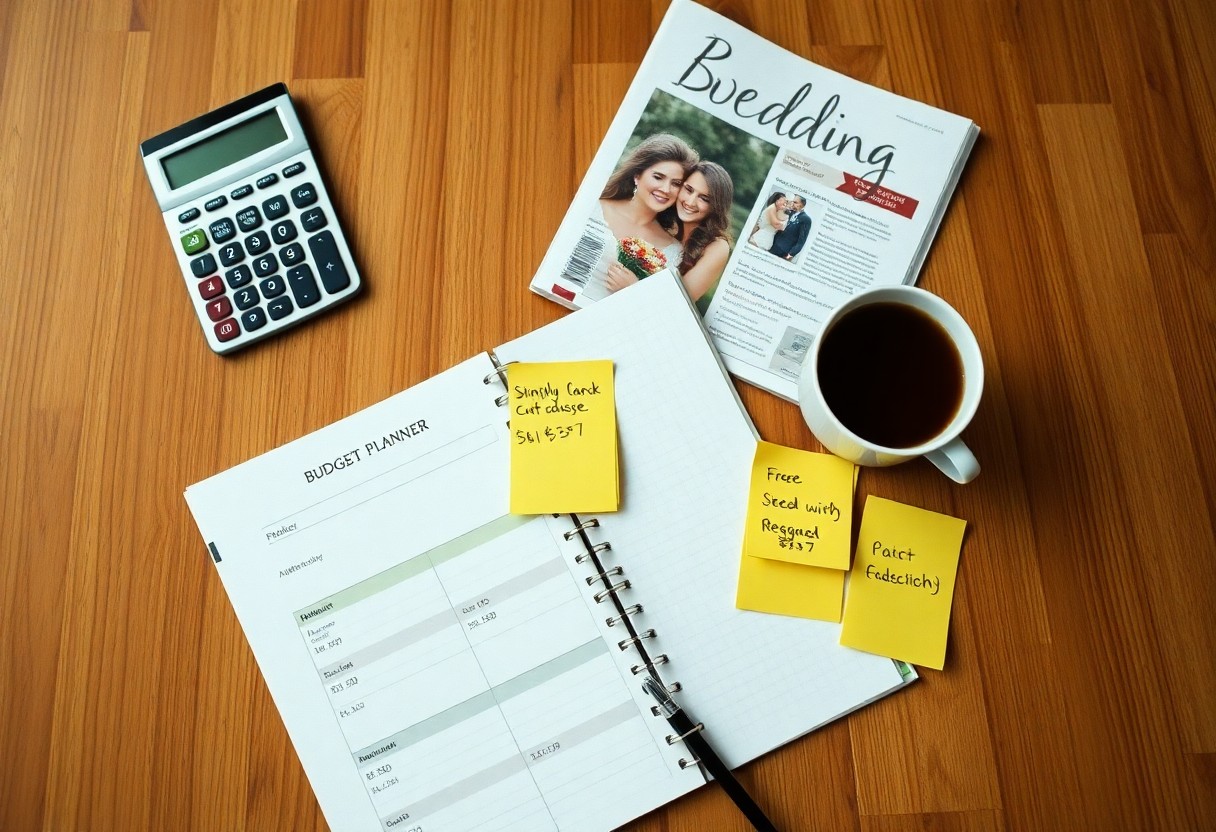

Creative How-to Solutions For Stress-Free Wedding Financing

Just because planning your wedding can be overwhelming doesn’t mean financing it has to be. You can simplify your financial decisions and ensure a beautiful celebration without breaking the bank. In this guide, you’ll discover innovative and effective strategies to organize your wedding budget, explore funding options, and even plan your expenses creatively. With these tips, you can focus more on your special day and less on financial stress.

Decoding Your Wedding Budget

Grappling with your wedding budget requires a strategic approach that unveils the hidden elements of your finances. Begin by listing every potential expense, from venue fees to floral arrangements, and categorize them into imperatives versus nice-to-haves. Then, consider your source of funds, whether it’s savings, family contributions, or a wedding loan. By understanding the broad landscape of your wedding expenses, you can gain greater control over your financial narrative and alleviate any budgeting stress as you plan your special day.

Crafting a Realistic Financial Blueprint

Creating a sensible financial blueprint starts with an honest evaluation of your overall situation. Take a close look at your income, savings, and any cash gifts you might receive. Once you have a complete picture, allocate funds to each category while considering any required adjustments to your lifestyle or spending habits leading up to the big day. This blueprint will serve as the backbone of your wedding financing strategy, ensuring you stay on track without any unexpected surprises.

Prioritizing Expenses: What Truly Matters

Identifying which wedding expenses hold the most significance allows you to allocate your budget effectively and enhance your planning experience. Focus on elements that reflect your style and personality, such as the venue and photographer. Consider what elements will create lasting memories versus those that may only last for a fleeting moment. By concentrating on experiences, you can cut costs on areas that matter less and pour your resources into aspects that create deeper connections and experiences for you and your guests.

For example, if you feel that a breathtaking venue is imperative to the overall atmosphere of your wedding, allocate a larger portion of your budget there. Conversely, if you don’t mind a more simplified cake or opting for DIY decor, you can redirect those savings to enhance your entertainment options or splurge on a better-quality photographer. This mindful prioritization allows you to create a unique, memorable wedding that aligns perfectly with your vision, all while sticking to a budget that feels feasible. Ultimately, it’s about balancing your dreams with your financial reality, creating a day that is just as unforgettable as it is affordable.

Unleashing Creative Financing Strategies

Unlock the potential of financing your wedding through innovative strategies. Traditional methods may not always suit your needs, which is where creativity comes in. By exploring inventive financing avenues, you can piece together your dream day while keeping stress at bay. Let the possibilities inspire you to find a custom route that balances your desires with your financial realities, ensuring that every aspect of your wedding feels achievable.

The Power of Crowd-Funding: Engaging Your Community

Crowd-funding is a savvy way to involve your community in your big day. Platforms like GoFundMe or Honeyfund allow friends and family to contribute to specific expenses or experiences, turning your wedding dreams into a collective celebration. This approach not only relieves financial pressure but also strengthens your bond with loved ones as they take part in your journey.

Exploring Alternative Loans and Funding Options

Investigating alternative loans and funding options can be key to financing your wedding without the burden of overwhelming debt. Look into personal loans from credit unions, peer-to-peer lending platforms, or even wedding-specific financing offered by vendors. These choices often come with lower interest rates or flexible repayment plans, allowing you to manage expenses more effectively while keeping your cash flow intact.

For example, peer-to-peer lending platforms like LendingClub offer personal loans with competitive rates that can easily cover your wedding costs. Many couples have turned to these options to secure funds quickly and efficiently, sometimes raising amounts up to $15,000 with minimal paperwork. Additionally, some credit cards offer introductory 0% APR on purchases, meaning you could finance your wedding expenses interest-free for a set period. This allows for budgeting without spikes in overall costs, offering flexibility when it counts most. The key lies in doing thorough research, comparing rates, and choosing the option that aligns best with your financial goals while keeping your wedding vision intact.

Navigating Vendor Negotiations Like a Pro

Successfully negotiating with vendors can save you significant amounts on your wedding expenses. Armed with research and a clear understanding of your budget, approach each vendor with an open yet determined mindset. Aim to foster a collaborative atmosphere where both parties can benefit. Don’t hesitate to ask for package deals, discounts, or added services that can enhance your experience without breaking the bank.

Mastering Effective Communication

Cultivating effective communication with your vendors lays the groundwork for positive interactions. Be clear about your budget, requirements, and vision from the start. Active listening is just as necessary; understanding their constraints or suggestions can open doors to creative solutions that align with your needs and budget.

Leveraging Off-Peak Seasons for Savings

Taking advantage of off-peak wedding seasons can lead to noteworthy savings. Many venues and vendors lower their rates during non-peak months, which can translate into significantly reduced costs. For instance, booking in January or February might yield discounts of 20-30% compared to the high-demand summer months.

Planning your wedding in the off-peak season not only benefits your budget but can also enhance your overall experience. Venues may have more flexibility in accommodating your requests, and vendors are often less booked during these times, making them more willing to negotiate. Consider picking a date on a weekday or during a less popular month, as this can lead to better service and availability at a fraction of the cost, allowing you to maximize your wedding budget and still have the day of your dreams.

Crafting a DIY Marriage: Cost-Effective Alternatives

Opting for a DIY wedding can significantly reduce costs while adding a personal touch. You can create your own invitations, decorations, and even centerpieces, which not only saves money but also lets you express your unique style. Many couples have successfully transformed simple materials into stunning visuals, channeling their creativity and resourcefulness. Tools like Pinterest can inspire your DIY projects, ensuring everything aligns with your vision without breaking the bank.

Rethinking Traditional Wedding Elements

Evaluate which wedding traditions are necessary for you and which can be modified or discarded. For instance, consider swapping a formal sit-down dinner for a casual buffet, or hosting a brunch instead of an evening celebration. By reimagining these elements, you can maintain the essence of your celebration while cutting significant costs without sacrificing style.

Harnessing the Power of Personalization for Affordability

Bringing a personal touch to your wedding can reduce costs and create memorable experiences. Custom elements like handwritten vows, personalized favors, and family recipes for the menu can replace expensive buys, adding sentimental value without inflated price tags.

Embracing personalization allows you to infuse your wedding with unique details that reflect your journey together. For example, ask family members to contribute homemade dishes for a potluck-style reception; this not only saves money but also fosters a sense of community and joy among your guests. Consider custom decorations made from items that hold meaning to you, such as a collection of your favorite book excerpts or quotes. Such thoughtful choices can keep expenses down while making your big day feel more intimate and special.

Value-Driven Choices: Quality Over Quantity

Focusing on quality over quantity allows you to curate a wedding experience that resonates deeply instead of simply overwhelming you with unnecessary items. Rather than splurging on a multitude of medium-quality elements, invest in fewer high-quality aspects that enhance the overall atmosphere and experience. For instance, you might choose to secure a fantastic photographer who can capture breathtaking images, rather than hiring multiple services that provide mediocre results. Prioritizing quality ensures that the memories created last a lifetime, both in your heart and in the photographs.

Investing in Key Experiences over Material Goods

Your wedding day is filled with moments that matter, so allocate your budget towards experiences that will resonate with you and your loved ones. Consider creating memorable experiences, such as unique entertainment for your guests or a personalized ceremony that reflects your relationship. By focusing on these experiences rather than an abundance of material goods, you reinforce the emotional significance of your wedding day. You’ll foster connections and laughter that will resonate more than any bouquet or centerpieces ever could.

Understanding the Long-Term Impact of Your Financial Decisions

The financial choices you make for your wedding can impact your future, particularly if they lead to debt or financial strain. It’s vital to consider how each expenditure aligns with your long-term goals. For example, spending excessively on a lavish venue might mean sacrificing important savings for future endeavors, such as home ownership or travel experiences. By keeping a close eye on the repercussions of your spending, you can create a wedding that celebrates love without jeopardizing your financial health.

Your financial decisions today shape the foundation for your future together. If you splurge on an extravagant wedding to impress others, you could enter marriage burdened by debt and stress. On the other hand, prioritizing experiences, a modest celebration, or quality items that you genuinely cherish can pave the way for a harmonious financial journey. Emphasizing this approach promotes a sense of responsibility and enjoyment as you begin your married life, ultimately leading to a more secure and joyful future, free from financial worries.

Final Words

Ultimately, by exploring creative how-to solutions for stress-free wedding financing, you can transform what may seem like a daunting task into a manageable and enjoyable experience. Whether you choose to budget wisely, explore alternative funding sources, or take advantage of financial tools, you hold the power to create a wedding that reflects your dreams without compromising your financial stability. With strategic planning and a clear vision, you can celebrate your special day with peace of mind and joy.